By contrast the insured makes few if any enforceable promises to the insurer. 04 Dec 2020 By.

Pdf Doc Free Premium Templates Denial Letter Templates Letter Sample

Read on to discover the definition of the term Unilateral - to help you better understand the language used in insurance policies.

. And when the recipient agrees to complete the requested task the contract is considered accepted. 660 of the Commercial Code Contracts can be unilateral or bilateral. Since it is a unilateral contract the insurer is not obligated to make a payment to the insured if the event does not occur.

By contrast the insured makes few if any enforceable promises to the insurer. Unilateral contract refers to a promise of one party to another that is legally binding. A unilateral contract refers to an agreement enforceable by contract law in which one party promises to reward another party for performing a particular act.

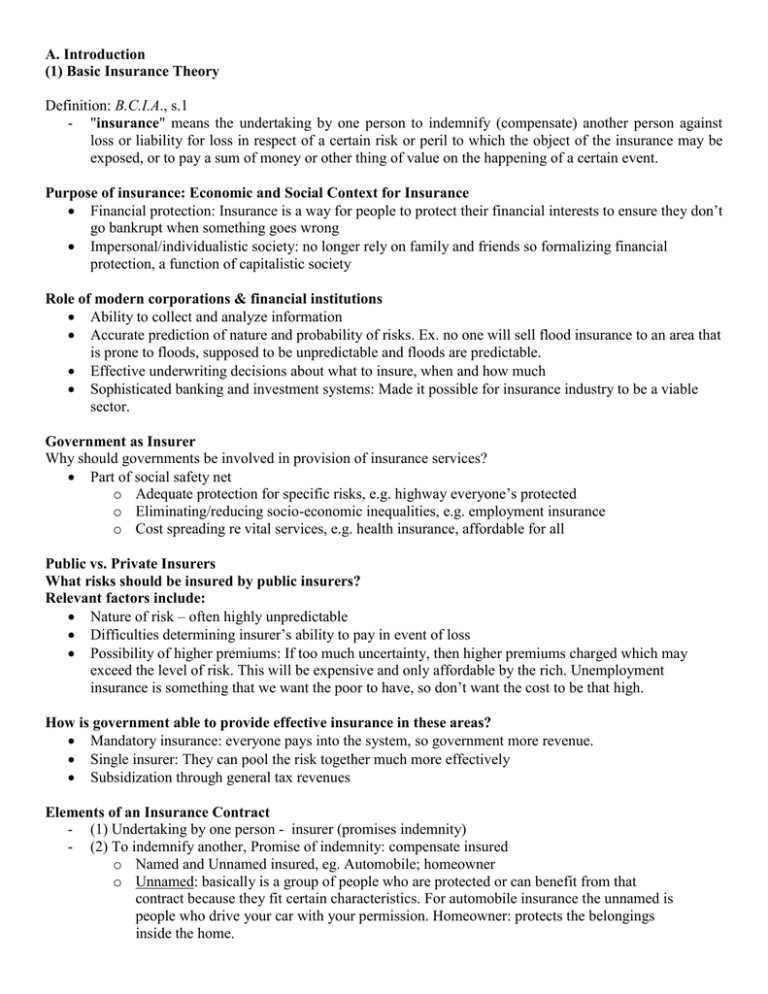

In an insurance contract the insurance firm promises to indemnify or pay the insured individual a specific amount of money if a certain event happens. An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. In an insurance contract if their property is lost or damaged the insurer offers to compensate people in a specified way.

On the other hand bilateral contracts need at least two parties to negotiate agree and act upon a promise. These contracts are developed to cater to the unique interests of some service providers contest managers and advertisers. The offer can only be accepted when the other party completely performs the requested action.

To form the contract the party making the offer called the offeror makes a promise in exchange for the act of performance by the other party. Another unique characteristic of insurance contracts is unilateral insurance. One of the biggest criticisms levelled against the use of standard form contracts is that the contract is one-sided or unilateral and results in the insurer wielding disproportionate power.

An aleatory contract is conditioned upon the occurrence of an event. Most insurance contracts are. Unilateral contracts rely on only one party to create a contract or promise for a specified or general group of people.

In a bilateral agreement both parties agree on an. This means that only one party the insurer makes any kind of enforceable promise. Insurance contracts are always considered to possess a legal purpose.

A unilateral contract is a contract created by an offer that can only be accepted by performance. Concerning the premium of this insurance. A unilateral contract refers to an agreement enforceable by the Indian Contract Law in which one party promisor promises to reward another party acceptor for performing a specific act.

Bilateral contracts are also very common. Title page and reference page are not considered. Distinguishing characteristic of an insurance contract in that it is only the insurance company that pledges anything.

The easiest way to understand a unilateral contract is to look at the word unilateral. Insurance policies are considered aleatory contracts because Performance is conditioned upon a future occurrence In an insurance contract the insurer is the only party who makes a legally enforceable promise. Instead the insured must only fulfill certain conditions such as.

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. A contract such as an insurance contract in which only one of the parties makes promises that are legally enforceable. A contract in which only one party makes an enforceable promise.

Unilateral Contract a contract in which only one party makes an enforceable promise. Simply put a unilateral contract is accepted after the action is completed while the bilateral contract is. Insurers promise to pay benefits upon the occurrence of a specific event such as death or disability.

Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. The contract is deemed accepted when the offeree agrees to complete the requested task. The other party doesnt have the same legal restrictions under the contract.

Since a property insurance contract is a personal contract it generally cannot be assigned to another party without the insurers consent. A unilateral insurance contract is based on the premise that a. Insurance contracts are unilateral.

There are some instances of unilateral contracts which are. The applicant makes no such promise. In the case of a unilateral contract only the tenderer has an obligation.

Each of the parties in a bilateral contract are simultaneously obligors owing another party the performance of some act and obligees those owed the performance of some act from another. In the digital age standard form contracts are automatically populated with user input and deliver almost-instant insurance via mobile applications. A bilateral contract is essentially an agreement between two or more parties binding all of them to reciprocal obligations.

It differs from a bilateral contract. Instead the insured must only.

The Characteristics Of Insurance Contracts Pdf Insurance Insurance Policy

Chapter 7 Insurance Contracts Contract Terminology A Contract

Engagement Letter Engagement Letter Letter Templates Lettering

Chapter 11 Insurance Contracts Ppt Download

Legal Principles Chapter 9 Flashcards Quizlet

Chapter 11 Insurance Contracts Ppt Download

Insurance 3 Insurance Contract And Insurance Companys Operations

Insurance 3 Insurance Contract And Insurance Companys Operations

Chapter 11 Insurance Contracts Ppt Download

Appeal For Health Insurance Why Appeal For Health Insurance Had Been So Popular Till N Life And Health Insurance Health Insurance Companies Health Insurance

2 Duration Of Insurance Contract

Lecture Five Analysis Insurance Contracts Ppt Download

Chapter 7 Insurance Contracts Contract Terminology A Contract

2 4 Long Duration Contracts Classification And Measurement

Insurance Contract Characteristics Traits Specific To Insurance Contracts Video Lesson Transcript Study Com